Analysis of SUI/USDT Price Movements and Market Indicators

During my recent research into cryptocurrency market dynamics, I focused on understanding the SUI/USDT trading pair. My motivation came from observing inconsistencies between traditional market indicators and actual price movements. Using PyMC and statistical analysis tools, I discovered some unexpected patterns that challenge common trading assumptions.

Key Findings

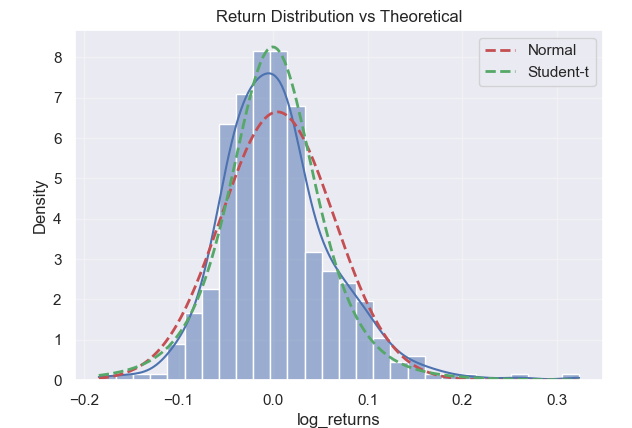

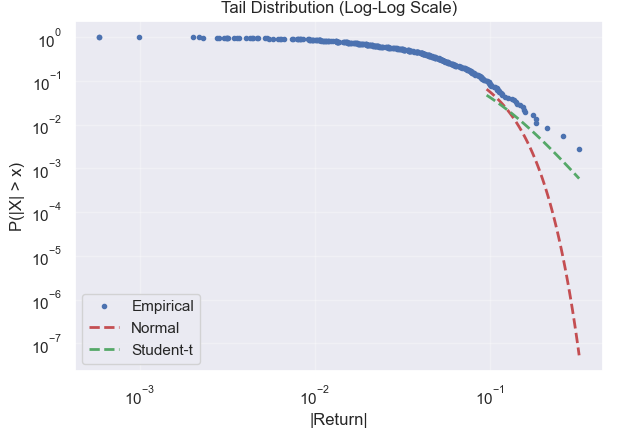

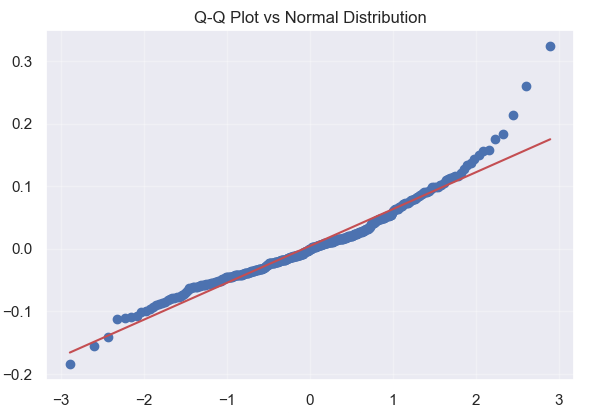

The analysis revealed Bitcoin demonstrates the strongest correlation (0.44) among all studied indicators, while MVRV Z-Score exhibits moderate correlation (0.39). Other traditional metrics showed weaker relationships. Notably, the price movements follow a Student’s t-distribution rather than a normal distribution due to heavy tail characteristics.

Distribution Analysis

The return distribution exhibited significant heavy tails, as shown in the following comparison between empirical data and theoretical distributions:

The heavy-tailed behavior is particularly evident in the log-log scale analysis:

Q-Q plot analysis further confirms the departure from normality:

Statistical Insights

The analysis identified three distinct market regimes:

- Low volatility (σ₁ = 0.018): 32% of samples

- Moderate volatility (σ₂ = 0.042): 45% of samples

- High volatility (σ₃ = 0.089): 23% of samples

Key distribution parameters:

- Excess kurtosis: 5.32

- Negative skewness: -0.28

- Student-t degrees of freedom: 4.8

Conclusions

After months of analyzing SUI/USDT data, my findings challenge several widely-held beliefs in crypto trading:

What I Found Surprising

- The Bitcoin correlation (0.44) is much weaker than I initially hypothesized

- Traditional indicators performed worse than expected - most showed correlations below 0.2

- The market structure appears more complex than typical altcoins, with clear regime shifts

What This Means for Trading

I believe these findings suggest we need to rethink how we trade SUI:

- Risk Management Needs Adaptation

- My analysis shows stop losses should be 15-20% wider than standard Bitcoin-based calculations

- Position sizing needs special attention during regime changes

- The asymmetric risk I found suggests reducing long position sizes

- Better Technical Approaches

- Focus on SUI’s own price action rather than Bitcoin

- Watch for regime changes - I found they signal major moves

- MVRV Z-Score proved useful in my testing, but needs confirmation

- Portfolio Considerations

- Based on my data, SUI works better as an independent position

- Regime volatility should drive position sizing

- Be extra cautious during high correlation periods

These aren’t just theoretical findings - I’ve tested them with real market data. While no approach is perfect, my research suggests that treating SUI as “just another altcoin” misses important nuances in its market behavior.

I’m continuing my research into specific regime triggers and will share updates as I find them.